Month-End Closing with Dynamics 365 Business Central

- John Ellis

- Aug 26, 2024

- 2 min read

Updated: Aug 29, 2025

For new users of Microsoft Dynamics 365 Business Central one of the most frequently asked questions is, “Does Business Central have a list of month end closing tasks?”

Not only is this a very good question raised by many accountants, but these accountants are hoping that Business Central houses month end tasks in one centralized location.

Developed by ASQiT Ltd., Finance Month End Dashboard is a free tool that accomplishes exactly this.

Month-End Closing with Dynamics 365 Business Central Steps

The Main Display

The tool’s display on the Role Center maintains screens for the following activities:

Journal Lines to Post

Recurring Jnl. Lines to Post

Fixed Assets to Depreciate

Bank Entries to Reconcile

Tax Entries to Settle

Currencies to Adjust

For the Period End date to appear accurately in the main dashboard, Allow Posting From and Allow Posting To in the General Ledger Setup and User Setup screens must be properly updated.

Clicking the numbered hyperlink located to the right of each month end activity will launch the screen where such activity will be performed.

Journal Lines to Post

Clicking the hyperlink to the right of either Journal Lines to Post or Recurring Jnl. Lines to Post displays Journals to Post, where you may click the “Edit Journal” button to review unposted journal entries and post them to close the month:

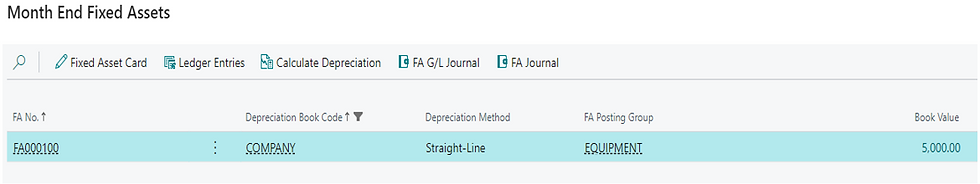

Fixed Assets to Depreciate

Since a fixed asset is typically depreciated for each fiscal month, Month End Fixed Assets is used to run this activity by clicking the “Calculate Depreciation” button:

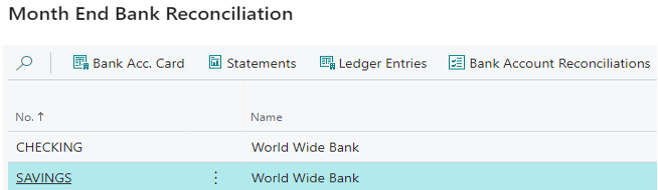

Bank Entries to Reconcile

Reconciling the bank statement monthly is a hallmark of a good accounting. Viewing Month End Bank Reconciliation, choosing the listed bank account, and clicking the “Bank Account Reconciliations” button takes care of a major monthly task:

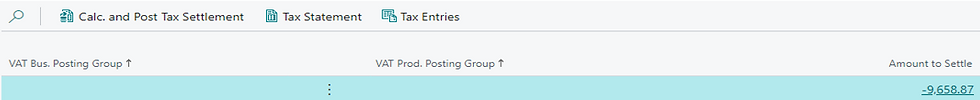

Tax Entries to Settle

Prior to clicking the “Calc. and Post Tax Settlement” button in Month End Tax Entries, you should click the hyperlink for Amount to Settle:

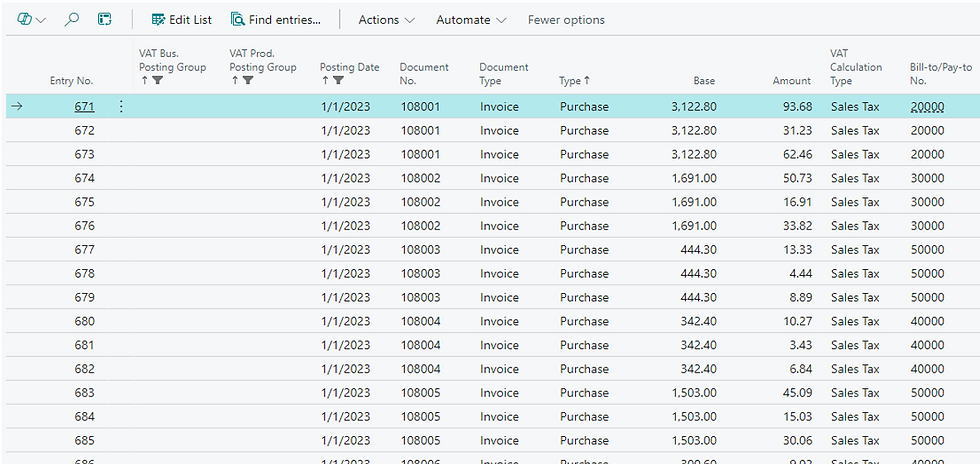

This drilldown provides very valuable data. in the way of journal entries that you can audit:

Currencies to Adjust

Reviewing any necessary currency reporting and clicking the “Update Exchange Rates” button is a necessary monthly step, in any multicurrency environment:

Why is Business Central Valuable?

Having month end tasks readily available makes Business Central the most valuable ERP application on the market, for accounting managers and controllers.

As a Microsoft Dynamics controller once said, “Having no surprises makes the accountant happy!”

Questions?